SURREY, BC — Home sales in the Fraser Valley posted a second consecutive bump in February as new listings continue to rise and trend slightly above the 10-year seasonal average.

The Fraser Valley Real Estate Board recorded 1,235 transactions on its Multiple Listing Service® (MLS®) in February, a 32 per cent increase over January but still 21 per cent below the 10-year average for sales in the region. New listings increased to 2,797 in February, up 18 per cent from January and 4 per cent above the 10-year average.

“There is somewhat of a buzz in the market right now,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “We are seeing new listings come onto the market and REALTORS® continue to see more traffic at open houses, however buyers are still exercising caution. We aren’t out of the woods just yet, but the signs are pointing to a further increase in activity as we head into spring.”

Active listings in February were 5,561, up by 14 per cent over last month and up by 26 per cent over February 2023. With a sales-to-active listings ratio of 22 per cent, overall market conditions are edging into a seller’s market. The market is considered balanced when the ratio is between 12 per cent and 20 per cent.

“All indications suggest we will see the Bank of Canada’s overnight rate begin to decrease mid-year, which is encouraging for buyers and sellers,” said FVREB CEO Baldev Gill. “With that confidence and the spring market on the horizon, we recommend anyone looking to buy or sell to seek the knowledge and guidance of a professional REALTOR® who can provide detailed analysis and intimate knowledge of the local market.”

The average number of days homes are spending on the market is dropping, with single-family detached homes spending 35 days on the market, down from 44 days in January, apartments spending 29 days on the market, down from 41 days in January and townhomes moving more quickly at 28 days, down from 33 days on the market in January.

After six months of decreases, overall Benchmark prices posted a slight bump in February, edging up 0.9 per cent from January and up 4.8 per cent over February 2023.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,485,600, the Benchmark price for an FVREB single-family detached home increased 1.3 per cent compared to January 2024 and increased 8.4 per cent compared to February 2023.

- Townhomes: At $831,000, the Benchmark price for an FVREB townhome increased 0.7 per cent compared to January 2024 and increased 6.7 per cent compared to February 2023.

- Apartments: At $546,100, the Benchmark price for an FVREB apartment/condo increased 1.2 per cent compared to January 2024 and increased 7.2 per cent compared to February 2023.

GOOD NEWS.

Signs of stability in Fraser Valley housing market

SURREY, BC — The Fraser Valley real estate market showed signs of recovery in January as home sales rose after six consecutive months of decline, and new listings more than doubled.

The Fraser Valley Real Estate Board recorded 938 transactions on its Multiple Listing Service® (MLS®) in January, a 12 per cent increase over December and below the 10-year average for sales in the region.

At 2,368, new listings increased 151 per cent in January, rebounding strongly from the seasonal lull seen in December. This is the largest month-over-month percentage increase in new listings in five years.

The average number of days homes are spending on the market has been increasing since October, with single family detached homes spending 44 days on the market, apartments spending 41 days on the market and townhomes moving more quickly at 33 days.

Overall Benchmark prices continued to edge downward for the sixth month in a row, losing less than half a per cent from December, and down six per cent from the 12-month peak in July.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,466,100, the Benchmark price for an FVREB single-family detached home decreased 0.4 per cent compared to December 2023 and increased 8.6 per cent compared to January 2023.

- Townhomes: At $825,600, the Benchmark price for an FVREB townhome decreased 0.1 per cent compared to December 2023 and increased 6.9 per cent compared to January 2023.

- Apartments: At $539,700, the Benchmark price for an FVREB apartment/condo increased 0.4 per cent compared to December 2023 and increased 6.5 per cent compared to January 2023.

|

Fraser Valley real estate market weakens as sales and prices continue to edge downward

SURREY, BC — Property sales and nw listings in the Fraser Valley fell again in October as consumers continued to put home buying and selling decisions on hold in the face of elevated interest rates.

The Fraser Valley Real Estate Board recorded 970 transactions on its Multiple Listing Service® (MLS®) in October, a drop of 12 per cent from the previous month and the fourth consecutive decrease since the 12-month high of 1,935 sales recorded in June.

At 2,535, new listings also fell again, decreasing by 11 per cent from September and by 28 per cent since peaking in May at 3,533.

“What we’re seeing in the Fraser Valley and indeed across the province is the impact of sustained high interest rates on the overall market,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “This has been the case since the latter half of the year so far, and we anticipate the trend will continue until we start to see some downward movement in the policy rate.”

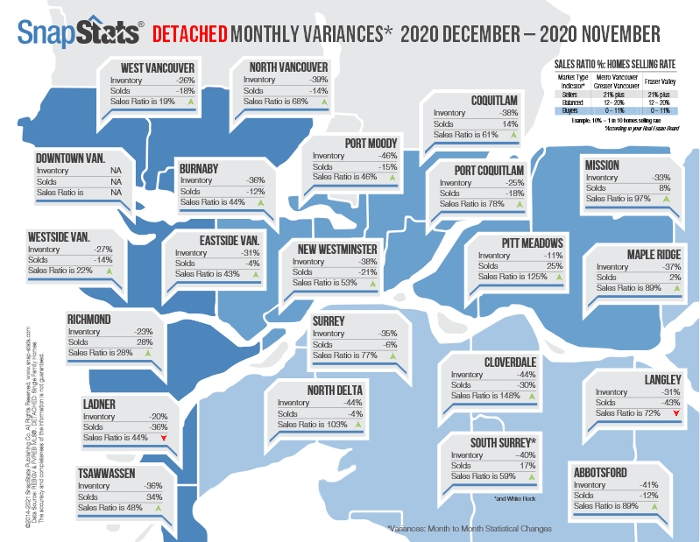

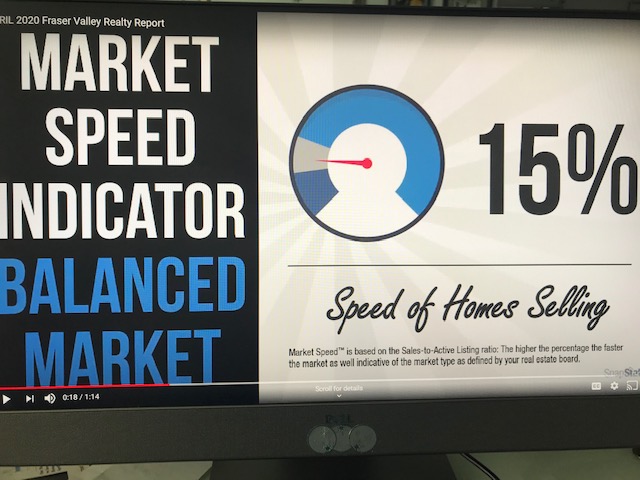

Active listings in October were 6,580, up by less than 1 per cent over last month and up by 17 per cent over October 2022. The sales-to-active listings ratio was 15 per cent, creating balanced conditions in the overall market, with detached houses dipping into buyers’ market territory at 12 per cent. The market is considered balanced when the ratio is between 12 per cent and 20 per cent.

“As the market continues to adjust to the new rate realities, pricing and financing strategies become critical,” said FVREB CEO, Baldev Gill. “A knowledgeable professional REALTOR®, armed with the latest comparative market data and neighbourhood insights, can be the key to determining optimal market timing.”

Overall benchmark prices continued to slide for the third month in a row, losing 1.4 per cent compared to September. See below for price changes by housing category.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,503,300, the Benchmark price for an FVREB single-family detached home decreased 1.5 per cent compared to September 2023 and increased 4.8 per cent compared to October 2022.

- Townhomes: At $845,300, the Benchmark price for an FVREB townhome decreased 0.4 per cent compared to September 2023 and increased 4.7 per cent compared to October 2022.

Apartments: At $545,400, the Benchmark price for an FVREB apartment/condo decreased 0.1 per cent compared to September 2023 and increased 3.7 per cent compared to October 2022.

Fraser Valley market balanced, as demand softens and prices edge lower

SURREY, BC – Continued slowing sales and a healthy rise in new listings in September has brought the Fraser Valley housing market into balance. Three months of declining sales has seen Benchmark prices dip for a second straight month.

The Fraser Valley Real Estate Board recorded 1,100 sales on its Multiple Listing Service® (MLS®) in September 2023, a decrease of 13.6 per cent compared to August. Sales were up 22.6 per cent compared to September 2022.

New listings rose to 2,860 in September, an increase of 9.1 per cent over last month, and 25.8 per cent above this time last year. Active listings have been rising since last December and grew again in September by 3.8 per cent to 6,532, 3.5 per cent below the ten-year average.

The market for detached homes softened again in September, with a sales-to-active listings ratio of 14 per cent, down from 16 per cent in August.

Demand for townhomes and apartments remained stronger (31 per cent and 25 per cent, respectively). The overall sales-to-active listing ratio is at 17 per cent, representing a balanced market. The market is considered balanced when the sales-to-active-listings ratio is between 12 per cent and 20 per cent.

Benchmark prices in the Fraser Valley dipped compared to last month with losses of less than one per cent across all property types.

On average properties spent a minimum of three weeks on the market before selling, with townhomes and apartments moving faster (23 and 24 days, respectively) than detached homes (29 days).

MLS® HPI Benchmark Price Activity:

• Single Family Detached: At $1,526,000, the Benchmark price for an FVREB single-family detached home decreased 0.6 per cent compared to August 2023 and increased 4.6 per cent compared to September 2022.

• Townhomes: At $848,600, the Benchmark price for an FVREB townhome increased 0.3 per cent compared to August 2023 and increased 3.5 per cent compared to September 2022.

• Apartments: At $545,900, the Benchmark price for an FVREB apartment/condo decreased 1.4 per cent compared to August 2023 and increased 3.4 per cent compared to September 2022.

Seasonality, interest rates temper sales in the Fraser Valley

SURREY, BC — After five months of successive increases, real estate sales in the Fraser Valley dropped in response to a combination of continued rising interest rates and the summer sales cycle.

The Fraser Valley Real Estate Board processed 1,368 sales in July on its Multiple Listing Service® (MLS®), a decrease of 29.3 per cent below June, but still 37.8 per cent above July 2022.

“Summer is typically a slower period for the real estate sector and the higher interest rates are contributing to the market slowdown,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “We’re seeing less traffic and fewer multiple offers as buyers and sellers put a pause on decisions and we expect this trend to continue until the fall cycle.”

The market for detached homes softened in July with a sales-to-active listings ratio of 17 per cent while demand for townhomes and apartments remained firm at 45 per cent and 36 per cent respectively. The market is considered balanced when the sales-to-active-listing ratio is between 12 per cent and 20 per cent.

Prices across all categories saw negligible increases compared to last month (see below).

“With rates at their highest levels in over 20 years and inflation still elevated, buyers and sellers are taking time to reevaluate their objectives,” said FVREB CEO Baldev Gill. “As housing options begin to take center stage on the Provincial agenda, consumers will want to consult a professional REALTOR® for a detailed picture of the market in their communities and to stay up to date on upcoming changes that may impact their decisions.”

On average, properties spent two to three weeks on the market before selling, with detached homes spending 22 days on the market, and townhomes and apartments moving slightly more quickly at 16 and 18 days, respectively.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,543,300 the Benchmark price for an FVREB single-family detached home increased 1.1 per cent compared to June 2023 and decreased 3.1 per cent compared to July 2022.

- Townhomes: At $850,300, the Benchmark price for an FVREB townhome increased 0.6 per cent compared to June 2023 and decreased 2.7 per cent compared to July 2022.

- Apartments: At $555,500, the Benchmark price for an FVREB apartment/condo increased 0.6 per cent compared to June 2023 and increased 0.8 per cent compared to July 2022.

Spring sales hold steady in Fraser Valley real estate market

SURREY, BC — Despite persistent inventory shortfalls, housing sales in the Fraser Valley remained steady in April as buyers took advantage of the continued pause in interest rate hikes.

In April, the Fraser Valley Real Estate Board (FVREB) processed 1,554 sales on its Multiple Listing Service® (MLS®), virtually unchanged compared to March and a slight decrease of 5.1 per cent compared to April 2022.

“Buyers are continuing to find opportunities in the Fraser Valley, even in the face of lower inventories,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “With prices remaining strong, we expect to see inventories increase over the coming months as sellers seek to capitalize on price growth after sitting out for so long.”

The Board received 2,478 new listings in April, off by 3.2 per cent compared to March, and down by 31.6 per cent compared to last year. The month ended with a total active inventory of 4,632, a 2.2 per cent increase over March, and 14 per cent less than April 2022.

“Our members are starting to see a rise in multiple offers on properties as the spring market kicks in,” said Board CEO, Baldev Gill. “With the heightened activity, many homeowners are asking: is now the right time to buy or sell? There is no simple — or single — answer to this question, but a wise first step would be to consult with a professional REALTOR® to determine the best path to meet your personal objectives.”

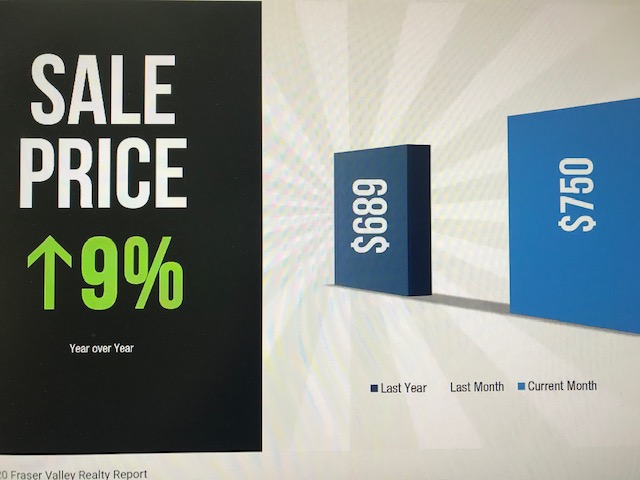

Low inventories helped nudge prices upward with the composite Benchmark price up by 2.8 per cent to $992,000 and single-family detached homes up by nearly four per cent, month-over-month.

Across Fraser Valley in April, the average number of days to sell a single-family detached home was 25 days and a townhome was 23 days. Apartments took, on average, 26 days to sell.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,442,900, the Benchmark price for an FVREB single-family detached home increased 3.8 per cent compared to March 2023 and decreased 17.8 per cent compared to April 2022.

- Townhomes: At $808,000, the Benchmark price for an FVREB townhome increased 1.7 per cent compared to March 2023 and decreased 13.3 per cent compared to April 2022.

- Apartments: At $530,200, the Benchmark price for an FVREB apartment/condo increased 1.6 per cent compared to March 2023 and decreased 9.8 per cent compared to April 2022.

FVREB Market Data: March 2023

Momentum continues to build in the Fraser Valley real estate market

SURREY, BC – March 2023 saw the second consecutive month of growth in sales in the Fraser Valley, and although still below seasonal norms, the trend is an encouraging sign that the region continues to head towards increased market stability.

At 1,550, property sales posted on the FVREB’s Multiple Listings Service (MLS®) were 72.6 per cent higher than sales recorded last month. Although 39.9 per cent lower than a year ago and nearly 25 per cent below the ten-year average, it marks the first time since August that monthly sales exceeded the 1,000 level.

“After months of uncertainty made it difficult for buyers and sellers to re-enter the housing market, we may well be seeing a turning point,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “The pause in rate hikes has helped to restore a much-needed sense of predictability, which is building consumer confidence. As a result, we’re starting to see more traffic at open houses along with more multiple offer situations.”

As in all regions across the province and the country, low supply is still an issue and a primary factor driving price growth.

Properties spent slightly fewer days on the market compared to last month with detached homes posting 30 days on the market and apartments 29. Townhomes moved faster, at 26 days.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,390,600 the Benchmark price for an FVREB single-family detached home increased 1.9 per cent compared to February 2023 and decreased 21.7 per cent compared to March 2022.

- Townhomes: At $794,400, the Benchmark price for an FVREB townhome increased 2.3 per cent compared to February 2023 and decreased 14.5 per cent compared to March 2022.

- Apartments: At $521,800 the Benchmark price for an

- FVREB apartment/condo increased 2.3 per cent compared to February 2023 and decreased 11 per cent compared to March 2022.

New listings, at 2,559, were 32 per cent higher than in February, but still 44.1 per cent below last year, while active listings were up by 2.8 per cent over last month and 3.5 per cent below last year. However, both are well off the ten-year average and among the lowest March listings recorded in a decade.

As a result, the aggregate sales-to-active listings ratio grew to 34 per cent, shifting the market into sellers territory, with demand for townhomes even more pronounced, at a 62 per cent ratio. (The market is considered balanced when the sales-to active listings ratio is between 12 per cent and 20 per cent.)

Benchmark prices continued to edge upward with roughly two per cent month-over-month growth across all categories. The composite Benchmark price was $965,100 in March.

“While market demand continues to trend up, we still face an uphill battle on the supply side, which is keeping prices elevated,” said FVREB CEO, Baldev Gill. “The province will require sustained inventory growth of at least 25 per cent over each of the next five years in order to normalize inventories. Until then, we strongly advise buyers and sellers to consult with a REALTOR® to plan the best strategy.”

SURREY, BC — House prices in the Fraser Valley posted a slight but positive bump in February after nearly a year of month-over-month decreases. Similarly, sales, though still trending lower than normal, also recorded their first monthly gain since October.

The Fraser Valley Real Estate Board (FVREB) processed 898 sales on its Multiple Listing Service® in February, an increase of 43.5 per cent over January but still only half as many as were recorded a year ago.

February new listings were also up, by 5.7 per cent over last month to 1,938 but 48.2 per cent lower than this time last year. Active listings grew by 7.0 per cent over January and by 16.3 per cent over February 2022.

The composite Benchmark price in February was $946,700 and though relatively flat compared to January with a negligible gain of 0.5 per cent, it reverses the price slide the market has been experiencing since April 2022. Further, while well below the record prices posted at that time, it is still more than 36 per cent higher than pre-pandemic February 2020.

“In recent months, the level of uncertainty regarding rates and prices has negatively impacted inventory and that’s kept a lot of clients on the sidelines,” said Sandra Benz, President of the Fraser Valley Real Estate Board. “Together with a growing consensus suggesting that a pause on rate hikes is imminent, the positive signals from the market give families something to build on and plan for. As that starts to happen we expect to see sales pick up slowly but steadily heading into spring.”

With a sales-to-active listings ratio of 20 per cent, the overall market was once again in balance, however the ratio for townhomes was higher at 36 per cent, indicating a seller’s market for this category. The market is considered in balance when the ratio is between 12 per cent and 20 per cent.

“All indications suggest that the market is on track to re-establish a level of stability, which is encouraging for both demand and supply sides,” said Baldev Gill, Chief Executive Officer of the Board. “With solid opportunities for properties that are appropriately priced, investing in the expertise of a professional REALTOR® should be the first decision buyers and sellers make to ensure the best local strategies before jumping back into the market.”

Properties spent between 7 and 12 fewer days on the market compared to last month, another sign that the market may be picking up. Across Fraser Valley in February, the average number of days to sell a single-family detached home was 36 and a townhome was 33 days. Apartments took, on average, 32 days to sell.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,364,300, the Benchmark price for an FVREB single-family detached home increased 0.5 per cent compared to January 2023 and decreased 21.5 per cent compared to February 2022.

- Townhomes: At $776,200, the Benchmark price for an FVREB townhome increased 0.4 per cent compared to January 2023 and decreased 13.8 per cent compared to February 2022.

- Apartments: At $510,100, the Benchmark price for an FVREB apartment/condo increased 1.3 per cent compared to January 2023 and decreased 10.5 per cent compared to February 2022.

Fraser Valley real estate sales record slowest annual start in ten years; January new listings lowest in over thirty years

SURREY, BC — The downward trend in Fraser Valley real estate sales continued in January as further interest rate hikes kept buyers sidelined.

With 626 transactions processed on the MLS®, sales were off by 12.6 per cent compared to last month and down by 52.2 per cent compared to this time last year. The last time January sales were this low was in 2013 at 617 sales.

“Buyers are understandably cautious, which explains the slow start to the year,” said Sandra Benz, President of the Fraser Valley Real Estate Board. “That said, the pent-up demand that has been building since the last quarter of 2022 will likely give rise to a sales uptick, especially if rate hikes subside, which we expect will be the case.”

Although new listings saw an increase of 128.3 per cent over last month to 1,833, they are at the lowest level of new supply for January since 1984.

Active listings rose slightly up 5 per cent to 4,118 over December 2022 and up by 76.6 per cent compared to this time last year.

“We also expect inventory to start increasing over the coming months as sellers act on decisions that have been on hold, waiting for rates to peak” added Benz. “As we start to see greater selection across all property categories, we should see demand pick up.”

At $942,200, the composite Benchmark home price continued to edge downward, slipping by 1.4 per cent from December and off by 15.1 per cent compared to January 2022.

“After a market slowdown for the past several months, the Board is expecting a return to seasonal activity leading into spring,” said FVREB CEO Baldev Gill. “With rates still elevated, however, buyers and sellers would be well-advised to seek out the guidance of a professional REALTOR® to determine the best strategy and timing to take advantage of the anticipated market upswing.”

Across Fraser Valley in January, the average number of days to sell a single-family detached home was 48, and a townhome was

40 days. Apartments took, on average, 41 days to sell.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,357,800, the Benchmark price for an FVREB single-family detached home decreased 1.4 per cent compared to December 2022 and decreased 17.6 per cent compared to January 2022.

- Townhomes: At $773,100, the Benchmark price for an FVREB townhome decreased 1.8 per cent compared to December 2022 and decreased 8.8 per cent compared to January 2022.

- Apartments: At $503,700, the Benchmark price for an FVREB apartment/condo decreased 0.2 per cent compared to December 2022 and decreased 5.9 per cent compared to January 2022.

December 2, 2022

New listings lag as Fraser Valley real estate market sees third month of declining sales

SURREY, BC – With sales down almost seven per cent from October, and new listings off by more than 20 per cent, the Fraser Valley housing market continues its slowing trend heading into the holiday season. Despite the market slowdown, opportunities are available, as evidenced by brisk turnover time frames. In November, the Fraser Valley Real Estate Board (FVREB) processed 839 sales on its Multiple Listing Service® (MLS®), a 6.9 per cent decrease compared to October and a decrease of 57.5 per cent compared to November 2021.

“The trends we’ve seen over the past several months will likely continue through to year-end,” said Sandra Benz, President of the Fraser Valley Real Estate Board. “While rate hikes have effectively put many buyers and sellers in a holding pattern, we’re still seeing relatively quick turnover for all housing categories, indicating robust opportunities for properties that are strategically priced.”

The Board received 1,703 new listings in November, a decrease of 22.1 per cent compared to October 2022 and a decrease of 18.8 per cent compared to last year. The month ended with a total active inventory of 5,330, a 5.5 per cent decrease compared to October, and 74.9 per cent more than November of last year.

“The market continues to tighten in response to rising interest rates,” said Board CEO Baldev Gill. “As a result, individuals are facing additional levels of uncertainty regarding the decision to buy or sell a home, underscoring the importance of seeking advice and guidance from a local REALTOR® to mitigate the risks involved.”

Across Fraser Valley in November, the average number of days to sell a single-family detached home was 34 days and a townhome was 28 days. Apartments took, on average, 27 days to sell.

MLS® HPI Benchmark Price Activity

• Single Family Detached: At $1,404,900, the Benchmark price for an FVREB single-family detached home decreased 2.2 per cent compared to October 2022 and decreased 6.3 per cent compared to November 2021.

• Townhomes: At $799,400, the Benchmark price for an FVREB townhome decreased 1.3 per cent compared to October 2022 and increased 3.3 per cent compared to November 2021.

• Apartments: At $518,400, the Benchmark price for an FVREB apartment/condo decreased 1.8 per cent compared to October 2022 and increased 5.2 per cent compared to November 2021.

Housing prices remain soft, sales flat, throughout the Fraser Valley

SURREY, BC — Fraser Valley housing market sales for October remained relatively unchanged from last month as prices dipped slightly across all categories.

In October, the Fraser Valley Real Estate Board (FVREB) processed 901 sales on its Multiple Listing Service® (MLS®), an increase of 0.4 per cent compared to last month and a 53.5 per cent decrease compared to this time last year.

The Board received 2,186 new listings in October, a decrease of 3.8 per cent compared to September, and on par with October 2021. The month ended with a total active inventory of 5,642, a decrease of 2.8 per cent from last month but up 63.7 per cent compared to October 2021.

With a sales-to-active listings ratio of 16 per cent, the overall market was again balanced for the fifth straight month after a prolonged sellers’ market earlier in the year. (The market is considered balanced when the sales-to-active listings ratio is between 12 per cent and 20 per cent.)

“These trends suggest that the market is looking to re-establish equilibrium in the wake of last year’s intense activity and in the face of continued interest rate pressures,” said Sandra Benz, President of the Fraser Valley Real Estate Board. “With sales continuing to lag and new inventory slow to come onstream, we’re seeing a holding pattern regarding whether to buy or list a property and expect this to continue through to year-end.”

Prices continued to soften, with month-over-month Benchmark prices down slightly across all property categories. For detached homes, prices are on par with October 2021 levels, while townhomes and apartments are up 7.7 per cent and 11.5 per cent, respectively, over 2021.

“With interest rates at their highest levels since 2006, it’s understandable that buyers and sellers are hesitant,” said Board CEO Baldev Gill. “Accordingly, they look to Fraser Valley REALTORS® for area knowledge and market expertise and analysis before making such a significant investment decision.”

The average number of days spent on the market before selling was relatively unchanged for detached homes and apartments compared to last month (34 days and 31 days, respectively). Townhomes moved more quickly at 27 days (compared to 32 days in September).

Single Family Detached: At $1,436,400, the Benchmark price for an FVREB single-family detached home decreased 1.8 per cent compared to September 2022 and decreased 0.8 per cent compared to October 2021.

- Townhomes: At $809,800, the Benchmark price for an FVREB townhome decreased 1.5 per cent compared to September 2022 and increased 7.7 per cent compared to October 2021.

- Apartments: At $527,900 the Benchmark price for an FVREB apartment/condo decreased 0.5 per cent compared to September 2022 and increased 11.5 per cent compared to October 2021.

Fraser Valley real estate market continues to stabilize heading into fall season

SURREY, BC — Continued slowing sales and a slight rise in inventory in September combined to bring greater stability to the Fraser Valley housing market.

In September, the Fraser Valley Real Estate Board (FVREB) processed 897 sales on its Multiple Listing Service® (MLS®), a decrease of 11.8 per cent compared to last month and a 51.9 per cent decrease compared to this time last year.

The Board received 2,273 new listings in September, an increase of 11.1 per cent compared to August, and only 2.9 per cent less than September 2021. The month ended with a total active inventory of 5,805, a decrease of 1.1 per cent from last month but up by 52.3 per cent compared to September 2021.

Once again, September saw a balanced market in the Fraser Valley with an overall sales-to-active ratio of 15 per cent (the market is considered balanced when the sales-to-active ratio is between 12 per cent and 20 per cent).

“There’s no question that interest rates continue to be a primary factor in the market trends over the past six months or so,” said Sandra Benz, President of the Fraser Valley Real Estate Board. “The sales slowdown we’re seeing reflects a level of caution exercised by buyers, who are likely waiting for the market to settle further before jumping in. In the meantime, we anticipate prices may continue to decline across all categories.”

Weaker demand in the face of interest rate hikes, continued to bring downward pressure on Benchmark prices across all property categories. Prices have been falling steadily since late spring and, in the case of detached homes, are at October 2021 levels.

“It’s encouraging to see inventories start to rise in the region, however slight,” said Board CEO Baldev Gill. “Adequate supply is a key underpinning of a vibrant and equitable housing market – not just in the Fraser Valley, but throughout the province. As we meet with candidates during the upcoming municipal elections and later on this month with MPs in Ottawa, FVREB Realtors will continue to press for swift action on this fundamental issue.”

Across the Fraser Valley in September, the average number of days spent on the market before selling continued to increase: 34 days for a single-family detached, 32 for townhomes, and 30 for apartments.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,462,000, the Benchmark price for an FVREB single-family detached home decreased 3.4 per cent compared to August 2022 and increased 4.1 per cent compared to September 2021.

- Townhomes: At $822,400, the Benchmark price for an FVREB townhome decreased 2.3 per cent compared to August 2022 and increased 11.6 per cent compared to September 2021.

Apartments: At $530,400 the Benchmark price for an FVREB apartment/condo decreased 2.1 per cent compared to August 2022 and increased 14.5 per cent compared to September 2021.

FVREB Market Data: August 2022

Fraser Valley housing market signals further settling as sales continue to stall in response to interest rate rises

SURREY, BC – Robust active listings and relative steady sales activity continued to bring balance to the Fraser Valley real estate market in August. The past several months of rising inventory combined with a slowing trend in sales has also seen benchmark prices return to levels not seen since last year.

In August, the Fraser Valley Real Estate Board (FVREB) processed 1,017 sales on its Multiple Listing Service® (MLS®), an increase of 2.4 per cent compared to last month and a 51.3 per cent decrease compared to this time last year.

The Board received 2,045 new listings in August, a decrease of 14.3 per cent compared to July, and only 2.9 per cent less than August 2021. The month ended with a total active inventory of 5,871, a decrease of 8.5 per cent from last month but up by 44 percent compared to August 2021. Once again August saw a balanced market in the Fraser Valley with an overall sales-to-active ratio of 17 per cent (the market is considered balanced when the sales-to-active ratio is between 12 per cent and 20 per cent).

For the past three months we’ve seen the local market return to a more balanced state,” said Board President, Sandra Benz. “With the Fraser Valley continuing to settle after months of record sales and prices, we expect to see more activity this coming fall as buyers look to capitalize on the region’s reputation for providing greater value for the real estate dollar.”

Benchmark prices continued to fall across all property categories, bringing them in relative line with prices from December 2021 and eating into year-over year gains.

“With possible further hikes in interest rates this fall, homebuyers need to augment their decisions with critical advice and guidance,” said Baldev Gill, Board CEO. “Along with other professionals such as mortgage brokers and lawyers, Fraser Valley REALTORS® are a vital part of the team advising buyers and sellers on market realities and identifying potential opportunities that align with their objectives.”

Across the Fraser Valley in August, the average number of days to sell a single-family detached home increased to 33 and for townhomes to 26 days. Apartments took, on average, 25 days to sell.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,513,500, the Benchmark price for an FVREB single-family detached home decreased 5.1 per cent compared to July 2022 and increased 9.8 per cent compared to August 2021.

- Townhomes: At $841,900, the Benchmark price for an FVREB townhome decreased 3.9 per cent compared to July 2022 and increased 16.1 per cent compared to August 2021.

- Apartments: At $542,000 the Benchmark price for an FVREB apartment/condo decreased 2.1 per cent compared to July 2022 and increased 18.4 per cent compared to August 2021.

Sales slide for fourth straight month as rising interest rates put brakes on Fraser Valley real estate market

SURREY, BC – The Fraser Valley real estate market saw sales fall again in July in the face of continued interest rate hikes, as the government struggles to bring inflation under control.

In July, the Fraser Valley Real Estate Board (FVREB) processed 993 sales on its Multiple Listing Service® (MLS®), a decrease of 22.5 per cent from the previous month and a 50.5 per cent drop compared to July 2021, when the province was still in acute pandemic mode. July new listings totaled 2,385, a 28.4 per cent decrease compared to June and a decrease of 1.9 per cent compared to July 2021.

Active listings, at 6,413, remained relatively unchanged from June and were up 30.9 per cent over last July — bringing the sector into balance for townhomes and detached homes (sales-to-active ratios: 18 per cent and 12 per cent, respectively); and favouring sellers slightly for apartments (28 per cent). The market is considered balanced when the sales-to-active ratio is between 12 per cent and 20 per cent.

The weaker demand resulted in prices dropping for the fourth consecutive month, most notably for detached homes which ended the month with a benchmark price of $1,594,400, down 3.5 per cent from last month and by 10.2 per cent since peaking at $1,776,700 in March. Residential combined properties benchmark prices are still up year-over-year by 18.1 per cent.

“It is important to keep in mind that real estate is and always will be an asset with considerable upside over the long-term,” said Fraser Valley Real Estate Board President, Sandra Benz. “As prices come down from the highs of recent months, there are opportunities for buyers who have been waiting to re-enter the market and shop for the right property."

Across the Fraser Valley in July, the average number of days to sell a single-family detached home was 24 and a townhome was 19 days. Apartments took, on average, 21 days to sell.

“With rising interest rates and uncertainty in the market, it is even more important to seek out the guidance of a professional REALTOR®,” said Board CEO, Baldev Gill. “Their ability to tap into the latest data and market intelligence — down to the neighbourhood level — allows buyers and sellers to make informed decisions about one of the largest transactions they’ll ever make.”

SURREY, BC – Overall sales in the Fraser Valley fell for the third straight month as prices for all property types continued to soften, bringing greater balance to the region’s real estate market.

In June, the Board processed 1,281 sales on its Multiple Listing Service® (MLS®), a decrease of 5.8 per cent compared to May and a 43 per cent decrease compared to June of last year.

Sandra Benz, President of the Board, said, “In just two months our market overall has shifted into balance mainly due to a softening of demand for single-family detached homes.

“The condos and townhome markets, although they have moderated, they continue to favour sellers as the sales-to-active listings ratios continue to trend higher, however with fewer multiple offer situations compared to previous months, it’s likely that we will see further softening in these property types as we return to pre-COVID work-life routines.”

In June, the Board received 3,332 new listings, an increase of 7.2 per cent compared to last year, and a decrease of 8.2 per cent compared to last month. The month ended with a total active inventory of 6,474, a 4.7 per cent increase compared to May, and 18.3 per cent more than June 2021.

Baldev Gill, Chief Executive Officer of the Board, added, “With five-year fixed rates at their highest levels in a decade and residential prices, though softening month-over-month, are still more than 20 per cent higher than a year ago, we expect to see sales continue to decline over the near term.

“The combination of higher rates and low inventory will present a barrier to first-time buyers and could result in even slower sales over the coming months and erase price gains from the past 10 months or so.”

Across Fraser Valley, in June, the average number of days to sell a single-family detached home was 21 and a townhome was 19 days. Apartments took, on average, 17 days to sell.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,653,000, the Benchmark price for an FVREB single-family detached home decreased 3.5 per cent compared to May 2022 and increased 21.9 per cent compared to June 2021.

- Townhomes: At $894,300, the Benchmark price for an FVREB townhome decreased 2.7 per cent compared to May 2022 and increased 26.6 per cent compared to June 2021.

Apartments: At $568,700, the Benchmark price for an FVREB apartment/condo decreased 2.2 per cent compared to May 2022 and increased 25.9 per cent compared to June 2021.

FVREB Market Data: May 2022

SURREY, BC – As property sales continue to fall in the Fraser Valley and active listings continue to grow, the region is edging towards more balanced levels not seen since the pre-pandemic period.

Sales of all property types in May were 1,360, down 16.9 per cent from April’s 1,637; and down 53.9 per cent compared to May of 2021.

At the same time, active listings (the number of properties available for sale at a given moment

during the month, in this case at the end of May) have more than tripled since December 2021.

At the end of May, actives sat at 6,183, up 5.4 per cent year-over-year, and an increase of 14.8 per cent compared to April 2022.

The sales-to-active-listings ratio measures whether the market is balanced (12% to 20%) or

favours either buyers (less than 12%) or sellers (greater than 20%). In May, the ratio for Fraser

Valley all property types combined was 22 per cent, comparable to pre-pandemic conditions in

early 2020. By comparison, during the pandemic, the ratio peaked at 92 per cent, indicating a

strong seller’s market.

“Since March, we’ve seen sales come down with an accompanying increase in inventory,

subsequently restoring much-needed balance and cooling our heated market,” said Fraser Valley

Real Estate Board President, Sandra Benz. “While still early, it suggests that as we gradually settle

into a post-pandemic state of work and life, the big pandemic-era drivers – working from home and record low interest rates – may have run their course.”

In May, MLS® HPI Benchmark prices for all three main property types decreased month-over-month for the first time since September 2019.

“The softening of prices will be welcome news for homebuyers, especially in the face of rising mortgage rates,” said Fraser Valley Real Estate Board CEO, Baldev Gill. “The volatility we’ve witnessed over the past couple of years not only underscores the power of external events to affect the market but, in light of recent trends, the ability of the market itself, to adapt and trigger corrective mechanisms.”

MLS® HPI Benchmark Price Activity*

- Single Family Detached: At $1,712,500, the Benchmark price for an FVREB single-family detached home decreased 2.4 per cent compared to April 2022 and increased 26.2 per cent compared to May 2021.

- Townhomes: At $918,900, the Benchmark price for an FVREB townhome decreased 1.4 per cent compared to April 2022 and increased 31.3 per cent compared to May 2021.

- Apartments: At $581,400 the Benchmark price for an FVREB apartment/condo decreased 1.1 per cent compared to April 2022 and increased 30.0 per cent compared to May 2021.

*The MLS® HPI measures the change in home prices in Canada and in May 2022, current and historical data underwent an annual update to ensure a more precise picture of home price trends.

|

|

FVREB posts record volume of new listings in February

HIGHEST MONTH OVER MONTH FOR ACTIVE LISTINGINGS IN 20 YEARS!! 62.5% HIGHER!!

SURREY, BC – Buyers of Fraser Valley real estate had significantly more inventory to choose from last month due to a record-breaking volume of new listings received for the month of February.

The Fraser Valley Real Estate Board (FVREB) received 3,742 new listings in February, an increase of 75.3 per cent compared to January, and an increase of 14.6 per cent compared to February of last year. The previous highest February for new listings was 3,283 in 2016.

The FVREB processed a total of 1,824 sales of all property types on its Multiple Listing Service® (MLS®) in February 2022, a decrease of 35.2 per cent compared to February 2021, and 39.2 per cent higher compared to January 2022. Sales remain strong at 18 per cent above the 10-year average.

By month end, February’s total active listings available for purchase were 3,790, a decrease of 8.0 per cent compared to the same month last year, however 62.5 per cent higher than what was available at the end of January. It’s the highest month-over-month increase in active listings in the Fraser Valley in 20 years.

“Although the market is still far from balanced, it is encouraging to see new listings increase again for the second month in a row,” said Fraser Valley Real Estate Board President, Larry Anderson.

“We’re hopeful that this trend will be sustained leading into the spring season as more sellers come on stream to help soften the market and provide opportunities for the many buyers who’ve been sidelined over the past year and a half.”

“Buyers are looking for value for their real estate dollar and the Fraser Valley market still delivers compared to other regions throughout the Lower Mainland,” said Baldev Gill CEO of the Fraser Valley Real Estate Board.

“That said, supply fundamentals continue to be the number one issue facing real estate markets in all regions across the province. Until there is a concerted effort to address inventory, buyers will continue to face challenging market conditions.”

In the Fraser Valley region, the average number of days to sell an apartment in February was 12 days, and 11 days for townhomes. Single family detached homes averaged 13 days before selling. The one-year comparison is 35, 21 and 21 respectively.

MLS® HPI Benchmark Price Activity

Single Family Detached: At $1,670,800, the Benchmark price for an FVREB single-family detached home increased 6.5 per cent compared to last month and increased 43.6 per cent compared to February 2021.

Townhomes: At $840,900, the Benchmark price for an FVREB townhome increased 5.6 per cent compared to last month and increased 40.1 per cent compared to February 2021.

Apartments: At $614,800 the Benchmark price for an FVREB apartment/condo increased 7.1 per cent compared to last month and increased 36.3 per cent compared to February 2021.

|

Fraser Valley real estate market sees busiest year in 100-year history

SURREY, BC – Fueled by the consumer response to the COVID‐19 pandemic along with historically low interest rates, total property sales in the Fraser Valley in 2021 shattered the previous annual record last set in 2016.

The FVREB processed 27,692 sales its Multiple Listing Service® (MLS®) in 2021, an increase of 39.0 per cent compared 19,926 sales in 2020; and 15.5 per cent higher than 2016’s 23,974 sales

.

Larry Anderson, President of the Board, said, “No one could have predicted how the pandemic would impact the real estate market. Our region's relative affordability, combined with a newfound ability to work from home and the value for housing dollar in the Fraser Valley attracted buyers in numbers like we’ve never seen.

In the month of December, the Board's MLS® processed 1,808 sales, second only to December 2020’s record-setting 2,086 sales. New listings in December were 1,278. By month's end, active inventory finished at 1,957 units, 60 per cent below the 10-year average, and the lowest in 41 years.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,500,000, the Benchmark price for an FVREB single-family detached home increased 3.6 per cent compared to November 2021 and increased 39.0 per cent compared to December 2020.

- Townhomes: At $765,800, the Benchmark price for an FVREB townhome increased 3.5 per cent compared to November 2021 and increased 32.9 per cent compared to December 2020.

- Apartments:At $549,200, the Benchmark price for an FVREB apartment/condo increased 3.5 per cent compared to November 2021 and increased 25.3 per cent compared to December 2020.

Fraser Valley home sales continued to soar in November further depleting supply

SURREY, BC – Robust demand for Fraser Valley real estate continued in November, with the Fraser Valley Real Estate Board (FVREB) recording the region’s second-highest volume of sales of all property types for the month – second only to November 2020.

In November, the FVREB processed 1,972 sales of all property types on its Multiple Listing Service® (MLS®), a decrease of 9.2 per cent compared to the 2,173 sales in November of last year, and a 1.8 per cent increase month-over-month compared to the 1,938 sales in October.

The Board received 2,096 new listings in November, a 4.2 per cent decrease compared to October’s intake and a decrease of 5.5 per cent compared to the 2,217 new listings received during the same month last year. The 10-year average for November new listings is 1,948, so last month finished slightly above normal levels.

Larry Anderson, President of the Board, said, “Lack of supply continues to be the biggest factor impacting the market. To see sales increase from October to November, even slightly, is unusual. Typically, as the weather changes and the holiday season approaches, we see sales start to decline, but not this year.

“This is not an easy market. Buyers and sellers alike are relying on the experience and skill of their REALTOR® to help them navigate a lack of supply, multiple offer situations, and very fast turnaround times.”

November finished with 3,048 active listings, a decrease of 11.6 per cent compared to October and a decrease of 47.9 per cent year-over-year, and an 11.6 per cent decrease compared to last month. In a typical November market, inventory levels in the Fraser Valley would be more than double.

Baldev Gill, Chief Executive Officer of the Board, said, “We’re seeing a number of factors at play, including historically low interest rates fueling purchases, with buyers aware that rates are likely to increase next year.

“Our province has seen a strong economic recovery in most sectors through this pandemic, and this strength bolsters home purchasing decisions.”

For the Fraser Valley region, the average number of days to sell an apartment in November was 24 days, and 16 days for townhomes. Single family detached homes remained on market for an average of 24 days before selling.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,448,000 the Benchmark price for a single family detached home in the Fraser Valley increased 3.7 per cent compared to October and, increased 36.4 per cent compared to November 2020.

- Townhomes: At $740,100, the Benchmark price for a townhome in the Fraser Valley increased 2.7 per cent compared to October and increased 29.8 per cent compared to November 2020.

- Apartments: At $530,400, the Benchmark price for apartments/condos in the Fraser Valley increased by 3.2 per cent compared to October and increased 21.7 per cent compared to November 2020.

MLS® sales in the Fraser Valley remained strong in October while supply continued to diminishSURREY, BC – Demand for Fraser Valley real estate remained solid in October with overall sales the third highest on record. The Board processed a total of 1,938 property sales on its Multiple Listing Service® (MLS®) in October, an increase of 3.9 per cent compared to September and a decrease of 18.2 per cent compared to the same month last year. Larry Anderson, President of the Board, said, “What we’re seeing is a combination of above‐average sales with below‐average new listings which is placing strong upward pressure on home prices, for all residential categories, month‐over‐month. “It is a very challenging time, particularly for buyers. I empathize with clients who have been trying to buy a home for more than a year without success after multiple attempts. Now, more than ever is the time when buyers and sellers alike must rely on their REALTOR® to guide and advise them in considering all available options, including a change in community or even property type.”

Baldev Gill, Chief Executive Officer of the Board, said, “Fraser Valley is a top destination currently in BC for buyers looking for relatively affordable family‐sized homes. Townhomes and single‐family homes are selling on average within two to four weeks in our region, with buyers keenly watching the market for new listings.” Across the Fraser Valley, in October, the average number of days to sell a single‐family detached home was 28 and a townhome was 18 days. Apartments took, on average, 27 days to sell. MLS® HPI Benchmark Price Activity

|

|

|

|

|

FVREB Market Data: September 2021

Demand for Fraser Valley real estate remained robust in September. While overall sales decreased compared to August, total sales reached the second-highest levels for the month of September in the 100-year history of the Board.

The Board processed a total of 1,866 property sales on its Multiple Listing Service® (MLS®) in September, a decrease of 10.6 per cent compared to August and a 16.4 per cent decrease compared to the same month last year.

Larry Anderson, President of the Board, said, “While we’ve seen a solid increase in new listings compared to August, market conditions continue to be challenging for buyers. Considering the demand across the region, the increase is simply not enough to bolster the inventory required to create greater balance in the market.

“Demand for residential homes of all types is strong in the Fraser Valley with more sellers returning to the table in September, which is expected at this time of year.”

In September, the Board received 2,342 new listings, a decrease of 33.4 per cent compared to last year, and an increase of 11.2 per cent compared to August 2021. The month ended with a total active inventory of 3,812, which is a 6.5 per cent decrease compared to August, and a 48.3 percent decrease compared to September 2020.

Baldev Gill, Chief Executive Officer of the Board, added, “The pandemic continues to have an impact on current conditions and while the market remains steady, we are sensitive to ongoing health and safety concerns. Our members follow stringent protocols as mandated by the Public Health Officer, and we will continue to lead by example for the benefit of our members and their clients.”

Across Fraser Valley, in September, the average number of days to sell a single-family detached home was 26 and a townhome was 19 days. Apartments took, on average, 26 days to sell.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,362,220, the Benchmark price for an FVREB single-family detached home increased 1.9 per cent compared to August 2021 and increased 31.9 per cent compared to September 2020.

- Townhomes: At $707,300, the Benchmark price for an FVREB townhome increased 1.4 per cent compared to August 2021 and increased 24.7 per cent compared to September 2020.

- Apartments: At $504,500, the Benchmark price for an FVREB apartment/condo increased 1.2 per cent compared to August 2021 and increased 15.5 per cent compared to September 2020.

FVREB Market Data: August 2021

A market of extremes: near record sales in August combined with lowest supply in four decades

SURREY, BC

– Demand for Fraser Valley real estate remained elevated in August reaching the second highest sales ever for the month against a backdrop of decreasing supply.

The Board processed a total of 2,087 property sales on its Multiple Listing Service® (MLS®) in August, an increase of 4.0 per cent compared to July and a 2.4 per cent increase compared to the same month last year. Sales remained unusually high for the month; second only to August of 2005.

Larry Anderson, President of the Board, said, “Home buyers are facing one of the worst supply shortages in Fraser Valley history. Our sales are over 30 per cent above normal, while our housing stock is at levels last seen in the early 80s.”

“To put our supply and demand situation in perspective, for every 100 townhomes on the market in August, Fraser Valley REALTORS® sold 94. The single-family detached and condo markets also remained in strong seller’s market territory. Persistent demand and lack of supply continues to put upward pressure on home prices.”

In August, the Board received 2,107 new listings, a decrease of 36.3 per cent compared to last year, and a decrease of 13.3 per cent compared to July 2021. The month ended with total active inventory sitting at 4,077, a 16.8 per cent decrease compared to July, and 44.9 per cent fewer than August 2020.

Baldev Gill, Chief Executive Officer of the Board, added, “To improve affordability, the BC government introduced the foreign buyers’ tax in 2016 and the federal government introduced the mortgage stress test two years later. And yet, in the last five years, the price of a typical detached home in the Fraser Valley has increased by 50 per cent.

“Those measures did not address the core issue, which is insufficient supply to meet the rise in our population growth. All levels of government must work together to correct the structural housing shortage.”

Across Fraser Valley, in August, the average number of days to sell a single-family detached home was 29 and a townhome was 19 days. Apartments took, on average, 29 days to sell.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,336,800, the Benchmark price for an FVREB single-family detached home increased 1.3 per cent compared to July 2021 and increased 31.1 per cent compared to August 2020.

- Townhomes:At $697,500, the Benchmark price for an FVREB townhome increased 1.3 per cent compared to July 2021 and increased 23.7 per cent compared to August 2020.

- Apartments:At $498,800, the Benchmark price for an FVREB apartment/condo increased 1.0 per cent compared to July 2021 and increased 14.1 per cent compared to August 2020.

SURREY, BC – Sales on the Fraser Valley Real Estate Board’s Multiple Listing Service® (MLS®) remained robust in June however, for the first time since last September, monthly sales did not break a historical record.

In June, the Board processed 2,247 sales on its MLS®, a decrease of 24 per cent compared to May and a 31 per cent increase compared to June of last year. Sales continued to remain elevated compared to a typical June – 22 per cent above the ten-year average.

Larry Anderson, President of the Board, said, “In June, we shifted from an extreme seller’s market to a strong seller’s market. Although demand for Fraser Valley homes remains very high – over 40 per cent of active listings sold in June – we’re seeing the market settle down giving buyers and sellers more room to maneuver.

“We’re now seeing more subject offers and for the first time in months, we’re starting to see price reductions.”

In June, the Board received 3,108 new listings, a decrease of 10 per cent compared to last year, and a decrease of 21 per cent compared to May 2021. The month ended with total active inventory sitting at 5,474, a 7 per cent decrease compared to May, and 22.5 per cent fewer than June 2020.

Anderson continued, “A lack of supply continues to be the single largest factor affecting the market. Simply put, to meet current demand and get back to balance, we need about 3,500 more active listings in our region.”

Across Fraser Valley, in June, the average number of days to sell a single-family detached home was 17 and a townhome was 12 days. Apartments took, on average, 21 days to sell.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,324,400, the Benchmark price for an FVREB single-family detached home increased 0.1 per cent compared to May 2021 and increased 33.2 per cent compared to June 2020.

- Townhomes: At $678,400, the Benchmark price for an FVREB townhome increased 1.3 per cent compared to May 2021 and increased 21.2 per cent compared to June 2020.

- Apartments: At $493,500, the Benchmark price for an FVREB apartment/condo increased 1.0 per cent compared to May 2021 and increased 13.4 per cent compared to June 2020.

Near record-breaking new listings in the Fraser Valley not enough to match insatiable buyer demand

SURREY, BC – Fraser Valley’s extraordinary pandemic real estate market continued to break sales records – for the ninth consecutive month – while at the same time, reaching near-historic levels of new listings in May.

In May, the Fraser Valley Real Estate Board (FVREB) processed 2,951 sales on its Multiple Listing Service® (MLS®), an increase of 267 per cent compared to May 2020 and a 2 per cent decrease compared to April. (Note that last year, the market was significantly restricted due to the lockdown.) The previous record high for sales in May for the Fraser Valley region was 2,911 in 2016.

Larry Anderson, President of the Board, said, “Demand hasn’t changed. What’s changed is supply. In the last three months, buyers have 40 per cent more inventory to look at in the Fraser Valley and it’s allowed them to take back a little control.

We’re seeing resistance to multiple offers and buyers adjusting their offers, or even waiting, because they have more selection.

We’re a long way from a balanced market, but supply is helping us to head in the right direction.”

In May, the Board received the second-highest volume of new listings ever; approaching May 2018 levels. The Board received 3,926 new listings in May, an increase of 78 per cent compared to last year, and a decrease of 22 per cent compared to April 2021. The month ended with total active inventory sitting at 5,868, a 3 per cent decrease compared to April, and 9 per cent less than May of last year.

Baldev Gill, Chief Executive Officer of the Board, added, “In the context of BC’s Restart Plan, it’s important to remind consumers that for now, when it comes to working with a real estate professional or booking a private showing, it’s status quo. Currently, there is no easing of pandemic restrictions in the real estate sector and our Board does not anticipate new guidelines for several weeks. Your REALTOR® will continue to guide you safely through the buying and selling process, following all public safety protocols, for as long as necessary.”

Across Fraser Valley, in May, the average number of days to sell a single-family detached home was 14 and a townhome was 12 days. Apartments took, on average, 20 days to sell.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,323,300, the Benchmark price for an FVREB

- single-family detached home increased 2.3 per cent compared to April 2021

- and increased 33.6 per cent compared to May 2020.

- Townhomes: At $670,000, the Benchmark price for an FVREB townhome increased 2.7 per cent compared to April 2021 and increased 20.7 per cent

- compared to May 2020.

- Apartments: At $488,500, the Benchmark price for an FVREB apartment/condo increased 2.0 per cent compared to April 2021 and increased 12.6 per cent

- compared to May 2020.

|

SURREY, BC – For the eighth consecutive month, Fraser Valley real estate saw record-breaking sales with April topping the previous monthly high set in 2016.

The 2020/2021 pandemic seller’s market in the Fraser Valley has now surpassed the previous longest stretch of seven consecutive, record-breaking months, last set in 2015/2016.

In April, the Fraser Valley Real Estate Board (FVREB) processed 3,016 sales on its Multiple Listing Service® (MLS®), an increase of 338 per cent compared to April 2020 and a 9 per cent decrease compared to March. (Note that sales and new listings in April 2020 were significantly restricted due to the pandemic lockdown.) The previous record high for sales in April was 2,969 in 2016.

Larry Anderson, President of the Board, said, “Although it remains very competitive and challenging for buyers, April could be the turning point in this historic market. In the last couple of weeks, we have seen evidence of a change in pace

“In general, we’re seeing fewer multiple offers, fewer subject-free offers, and homes over-priced are starting to sit longer. These are positive signs that the market is responding to near-record levels of new inventory.”

The Board received the highest volume of new listings ever in March 2021 and that elevated pace continued in April. Last month, the Board received 5,018 new listings, an increase of 254 per cent compared to April 2020, and a decrease of 1 per cent compared to March 2021. The influx of new listings improved supply with total active inventory reaching 6,030 in April 2021, 20 per cent higher than in March and the highest it’s been in six months.

Baldev Gill, Chief Executive Officer of the Board, added, “Buyers and sellers will note that we’re already seeing increases in home prices start to slow in response to the new supply.

“If you have an active listing now or are thinking of selling, it’s critical to work with a professional REALTOR® to ensure your asking price is realistic and competitive based on today’s market, not yesterday’s.”

Across Fraser Valley, in March, the average number of days to sell a single-family detached home was 13 and a townhome was 10 days. Apartments took, on average, 22 days to sell.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,293,300, the Benchmark price for an FVREB single-family detached home increased 4.5 per cent compared to March 2021 and increased 30.3 per cent compared to April 2020.

- Townhomes: At $652,400, the Benchmark price for an FVREB townhome increased 4.5 per cent compared to March 2021 and increased 18.0 per cent compared to April 2020.

- Apartments: At $478,700, the Benchmark price for an FVREB apartment/condo increased 2.9 per cent compared to March 2021 and increased 9.3 per cent compared to April 2020.

If you are thinking about Selling........Please call me. Timing is everything in Real Estate. The market is showing signs of turning. To get the maximum out of your home, Now is the get time to get your home on the market. As the inventory increases, Sellers who become buyers will have more inventory to choose from.

March shatters monthly sales and new listings records in the Fraser ValleySURREY, BC – Fraser Valley real estate hit two historical highs in March, setting records for both sales and new listings processed in one month since the Fraser Valley Real Estate Board’s (FVREB) inception in 1921. In March, the FVREB processed 3,329 residential and commercial sales on its Multiple Listing Service® (MLS®), an increase of 131 per cent compared to March 2020 and 18 per cent more than were processed in February. The previous record of 3,006 sales was set in March of 2016. Larry Anderson, President of the Board, said of this month’s statistics, “This market is uncharted territory for Fraser Valley real estate. The surprising strength of the economy, the influence of the pandemic and a lack of inventory of all property types has created unprecedented demand for housing in our region.

“Realtors take this extra duty to protect their clients during private, in-person showings very seriously and will continue to remain vigilant until vaccines are rolled out to the greater population,” added Gill. Across Fraser Valley, in March, the average number of days to sell a single-family detached home was 15 and a townhome was 14 days. Apartments took, on average, 31 days to sell.

MLS® HPI Benchmark Price Activity

|

Another month, another record for property sales in the Fraser Valley

SURREY, BC – For the sixth consecutive month, Fraser Valley’s real estate market experienced property sales at levels never seen before in the 100-year history of the Fraser Valley Real Estate Board (FVREB).

In February, the FVREB processed a total of 2,815 sales on its Multiple Listing Service® (MLS®), an increase of 108 per cent compared to February 2020 and 64 per cent more than were processed in January 2021. To provide a historical perspective, sales in February were 88 per cent above the 10-year average for that month; and 18 per cent higher than the previous record of 2,387 sales in February 2016.

Chris Shields, President of the Board said of this month’s record numbers, “This is new territory for us. We have never seen such consistent and persistent demand for housing in the Fraser Valley.

“What’s fueling the demand is the combination of record-low interest rates and the response to the pandemic. It’s not something that could have been predicted and it has created a very complex market for buyers that requires the knowledge and expertise of a professional. For family-sized homes, prices climbed 3 to 5 per cent in February alone and sold on average in three weeks. We understand the stress and frustration with the market currently and we’re here to help guide and protect home buyers.”

The Board received 3,265 new listings in February, an increase of 28 per cent compared to February of last year, placing it second highest for February for new listings in the last decade. The total active inventory for February was 4,120, down 28 per cent from last year’s 5,741 active listings, and the lowest ever for the month.

Baldev Gill, Chief Executive Officer of the Board, added, “We know more people are choosing to move to the Fraser Valley right now because they’re seeking more usable space, a better quality of life, and they recognize that their housing dollar goes further. The challenge is selection. We anticipate as the vaccination roll-out accelerates, confidence to list will increase and we’ll see inventory return to more normal levels. In the meantime, REALTORS® will continue to ensure consumer safety is at the forefront of all home viewings and transactions.”

Across Fraser Valley, in February, the average number of days to sell a single-family detached home and a townhome was 21 days. Apartments took on average 35 days to sell.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,163,400, the Benchmark price for an FVREB single-family detached home increased 5.1 per cent compared to January 2021 and increased 19.9 per cent compared to February 2020.

- Townhomes: At $600,300, the Benchmark price for an FVREB townhome increased 3.4 per cent compared to January 2021 and increased 10.1 per cent compared to February 2020.

- Apartments: At $450,900, the Benchmark price for an FVREB apartment/condo increased 2.5 per cent compared to January 2021 and increased 5.3 per cent compared to February 2020.

Fraser Valley real estate market full steam ahead in January; another record-setter for property sales

SURREY, BC – In a month that is usually one of the quietest in real estate, Fraser Valley’s market continued at a breakneck pace, producing the strongest January sales on record as well as a modest uptick in new listings.

The Fraser Valley Real Estate Board processed a total of 1,718 sales of all property types on its Multiple Listing Service® (MLS®) in January 2021, an increase of 76 per cent compared to January 2020 and 18 per cent fewer then were processed in December 2020. Sales in January set a new, record high for the month; 72 per cent above the 10-year average, and 28 per cent higher than the previous record of 1,338 sales set in January 2016.

“Buyers are very motivated right now,” said Chris Shields, President of the Board, “Lending rates are the lowest they’ve ever been, your housing dollar goes further in the Fraser Valley and we’ve seen a societal shift in the last year in how people value their homes. People are asking us to find them more space.

People want to take advantage of the gains they have my in their homes. The challenge is supply. It improved slightly in January, but we’ve got a long way to go to replenish our housing stock. It remains a seller’s market.”

The Board received 2,784 new listings in January 2021, an increase of 26 per cent compared to January of last year. Total active inventory for the month was 4,210, down 18 per cent from last year’s 5,143 active listings, and still 30 per cent below the 10-year average.

Baldev Gill, Chief Executive Officer of the Board, added, “Homeowners may be reluctant to sell because of concerns about buying and selling safety protocols; or the challenge of finding a new home to buy. The industry has worked hard to make it as easy as possible for you to thoroughly evaluate homes online first and then, for serious, final consideration, strict regulations are in place for in-person viewing.”

“And note, we’re already seeing an improvement in supply levels compared to December, a trend we anticipate that will continue as spring approaches bringing what is typically one of the busiest markets of the year.”

n January 2021, the average number of days to sell a single-family detached home in the Fraser Valley was 35, compared to 60 days in January 2020; 28 days on average to sell a townhome and 37 days for apartments, compared to 47 and 49 days respectively, in January of last year.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,106,500, the Benchmark price for an FVREB single-family detached home increased 2.5 per cent compared to December 2020 and increased 15.2 per cent compared to January 2020.

- Townhomes: At $580,800, the Benchmark price for an FVREB townhome increased 0.8 per cent compared to December 2020 and increased 7.2 per cent compared to January 2020.

- Apartments: At $439,800, the Benchmark price for an FVREB apartment/condo increased 0.3 per cent compared to December 2020 and increased 4.4 per cent compared to January 2020.

Record-shattering December caps unexpected year in Fraser Valley real estate

SURREY, BC – In a year when the real estate market was at a standstill for months due to COVID-19, total annual sales in the Fraser Valley still finished 12.4 per cent above the 10-year average due to unrelenting, pent-up consumer demand during the second half of 2020.

In December, the Board’s Multiple Listing Service® (MLS®) processed a staggering 2,086 sales, the strongest December on record and 81.2 per cent above normal for the month. New listings in December, were the second highest on record at 1,502. By month’s end, active inventory finished below typical levels, at 3,949 units.

The total sales volume for the year in Fraser Valley was 19,926; an increase of 28.7 per cent compared to 2019’s 15,487 sales and placing it fourth highest for annual sales since 2011.

In 2020, sales of the three main residential property types were as follows: 8,176 single-family detached; 5,102 townhouses; and 4,357 apartments. Year-over-year, sales of detached soared by 41.7 per cent compared to 2019; townhome sales increased by 31.2 per cent and sales of apartments increased by 5.9 per cent.

Chris Shields, President of the Board, observes, “The pandemic upended everything in 2020 and how the real estate market responded to it was nothing short of remarkable. No one could have anticipated a six-month stretch like we’ve just experienced. Typical seasonal cycles did not apply, how we conduct business had to change to keep the public safe; and most unexpected, has been the unwavering demand for family-sized homes in our region and so far, there is no sign of it slowing down.”

A total of 31,693 new listings were received by the Board’s MLS® in 2020, an increase of 3.7 per cent compared to 2019. As with annual sales, 2020 was also the fourth highest year for new inventory for the Board in the last decade.

Baldev Gill, Chief Executive Officer of the Board, adds, “Although listing volumes appear healthy, our region’s current overall inventory is 28 per cent below normal. For those who have been thinking of selling but have held off due to the pandemic, the industry has mastered how to keep consumers safe using technology and strictly following provincial health guidelines. Ask your REALTOR® if now is a prudent time to list because the market currently is favouring sellers.”

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,079,500, the Benchmark price for an FVREB single-family detached home increased 1.7 per cent compared to November 2020 and increased 13.3 per cent compared to December 2019.

- Townhomes: At $576,200, the Benchmark price for an FVREB townhome increased 1.1 per cent compared to November 2020 and increased 6.9 per cent compared to December 2019

- .

- Apartments: At $438,300, the Benchmark price for an FVREB apartment/condo increased 0.6 per cent compared to November 2020 and increased 4.7 per cent compared to December 2019.

Unrelenting demand for Fraser Valley detached and townhomes continued in November

The Fraser Valley Real Estate Board processed 2,173 sales of all property types on its Multiple Listing Service® (MLS®) in November, an increase of 54.7 per cent compared to the 1,405 sales in November of last year, and an 8.3 per cent decrease month-over-month compared to the 2,370 sales in October. The Board received 2,217 new listings in November, a 28.0 per cent decrease compared to October’s intake and an 18.1 per cent decrease compared to the 1,877 new listings received during the same month last year. For November, it was the second highest volume of new inventory in the last decade. Chris Shields, President of the Board, observes, “We’re running out of superlatives. We expected November activity to moderate due to the season, but the desire for family-sized homes and their benefits continues to dominate. Since the summer, we’ve seen the strongest demand in our Board’s 99-year history specifically for single-family detached and townhomes."

|

Housing market activity reaches historic levels in September

SURREY, BC – Consumer demand for real estate in the Fraser Valley remained robust for the fourth consecutive month, with overall sales and new listings reaching record-breaking numbers in September.

The Fraser Valley Real Estate Board processed 2,231 sales on its Multiple Listing Service® (MLS®) in September, an increase of 66.1 per cent compared to the same month last year and an increase of 9.4 per cent compared to August 2020. This is the highest recorded sales for September in the history of FVREB.

In the last three months, Fraser Valley has seen a defined shift in demand towards single family detached homes with sales in July through to September garnering 47 per cent of the three main residential types, compared to 43 per cent during the same period last year.

Chris Shields, President of the Board, observes, "Our homes have never been more important. Across the Fraser Valley, we’re seeing a trend towards buyers looking for more space and livability in both single-family homes and townhomes.In September, the average number of days to sell an apartment was 35; 25 for townhomes, and 28 for single family detached.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,032,700 the Benchmark price for a single-family detached home in the Fraser Valley increased 1.3 per cent compared to August and, increased 8.7 per cent compared to September 2019.

- Townhomes: At $567,300, the Benchmark price for a townhome in the Fraser Valley increased 0.6 per cent compared to August and increased 4.0 per cent compared to September 2019.

- Apartments: At $436,900, the Benchmark price for apartments/condos in the Fraser Valley decreased by 0.1 per cent compared to August and increased 4.7 per cent compared to September 2019.

In April, the average number of days to sell an apartment was 31; 30 for townhomes and 33 for single family detached.

MLS® HPI Benchmark Price Activity